how long does coverage normally remain on a limited-pay life policy

Limited Coverage Options Depending on the insurer you may not have access to higher death benefits or insurance riders. This is the main reason that term insurance is far less expensive than whole and universal life.

Common terms are 10 15 or 20 years or up to.

. Limited Payment Life Insurance a life insurance policy that covers the insureds entire life with premium payments required only for a specified period of years. Ad A Policy Will Protect Provide For Your Loved Ones When You No Longer Can. Apply Online and Save 70.

As Low As 349 Mo. The same policy would cost a 65-year-old male roughly 37490 per year. Limited pay life insurance is a payment plan with level premiums for a condensed amount of time rather than paying premiums for your whole life.

Limited pay policies work well for people who. A 40-year-old male will pay around 17225 per year on a 10 pay policy with 500000 coverage. Premiums on limited payment life insurance are paid for a limited number of years but the.

How long does the coverage normally remain on a limited pay life policy. This is why comparing plans is critical. Ad Exclusive term life insurance from New York Life.

At that point all premiums will have been. Limited pay life insurance is a type of whole life insurance. Premiums are typically paid over the first 10 to 20 years.

Premiums are usually paid over a period of 10 to 20. How long does the coverage normally remain on a limited-pay life policy. How long does the coverage normally remain on a limited-pay life policy.

Some people opt for this policy over a 10 pay because the premiums are. A limited pay life insurance policy allows you to pay your insurance premiums in full within a certain time frame. Ad Funerals are expensive.

Ad No Medical Exam-Simple Application. Limited pay life insurance is for an individual who owns a whole life insurance policy but chooses to pay for the total cost of their premiums for a limited number of years. How long does the coverage normally remain on a limited-pay life policy.

A limited-pay life policy is a type of whole life insurance policy that you can pay off in advance. 455 73 votes. A limited payment life insurance policy is one in which premium payments are paid for a fixed length of time for example 15 years.

How long does the coverage normally remain on a limited-pay life policy. On older policies that could be as low as age 95. Paid Until Age 65.

Limited PAY Whole Life means you pay it for 1020 years and the payment stops but the coverage lasts to maturity. Lets start by looking at the different payment terms. Up to 150000 in coverage.

Top Life Insurance Providers from 15Month. How long does the coverage normally remain on a limited-pay life policy. Typically these types of policies are paid off in 10-20 years.

When choosing the limited pay whole life option the payment length must be determined at the initial purchase of the policy. Answer 1 of 2. Help protect your loved ones with valuable term coverage up to 150000.

A 15 pay whole life policy provides coverage that lasts your entire life with premiums due for 15 years. When selecting the limited pay whole life option the payment length must be selected at the time of policy acquisition. Answer 1 of 3.

What type of life insurance gives the greatest amount of coverage for a limited period of time. As a general rule of thumb fewer years results in a. Age 100 Even though the premium payments are limited to a certain period the insurance protection extends until.

Let them celebrate your life rather than worry about the cost of a funeral. K pays on a 20000 20-Year Endowment policy for 10 years and dies from an automobile accident. Life Insurance retirement Whole Life Insurance.

Prepare with guaranteed life insurance from 995. The most common options include.

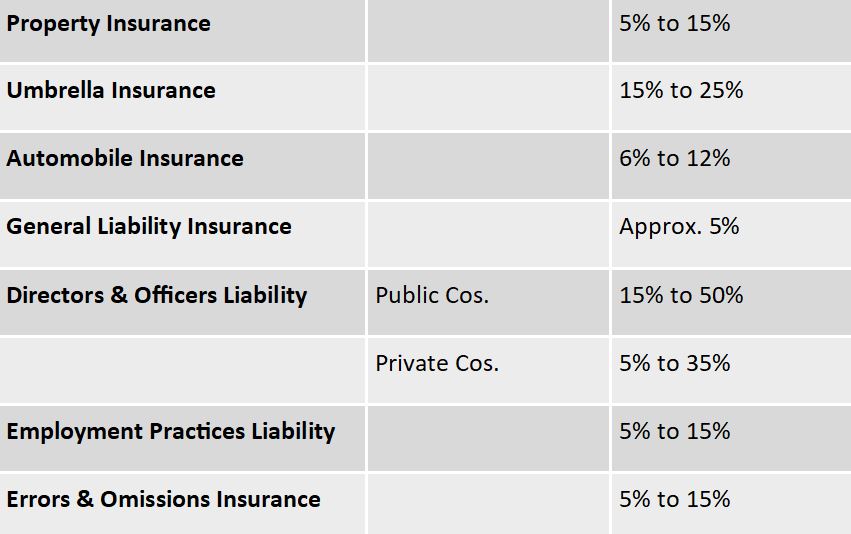

Hard Market Vs Soft Market Psa Insurance And Financial Services

:max_bytes(150000):strip_icc():gifv()/New_York_Life-fe244fbe4c0b4c3a842fa2c15f06f2c7.jpg)

New York Life Insurance Review 2022

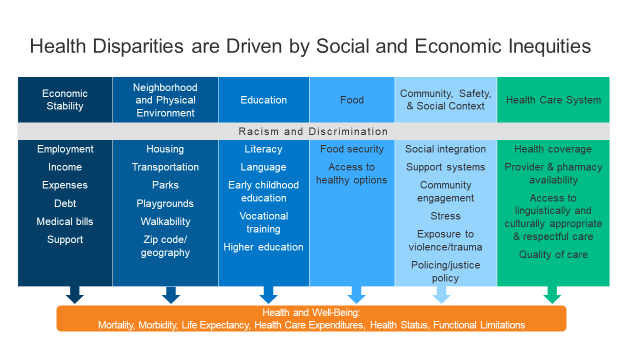

Disparities In Health And Health Care 5 Key Questions And Answers Kff

Best No Exam Life Insurance Of August 2022 Forbes Advisor

What Happens To Your Life Insurance When You Leave A Job Bankrate

Best No Exam Life Insurance Of August 2022 Forbes Advisor

Best No Exam Life Insurance Of August 2022 Forbes Advisor

Umbrella Insurance How It Works And What It Covers Forbes Advisor

The Cheapest And Best Full Coverage Car Insurance Of 2022 Valuepenguin

/New_York_Life_Recirc-e05045fd08f44f36952e68ef2e2b19c0.jpg)

New York Life Insurance Review 2022

Best No Exam Life Insurance Of August 2022 Forbes Advisor

Introduction To The Waiver Of Premium For Payer Benefit Definition

Best Whole Life Insurance Companies Of 2022 U S News

Best No Exam Life Insurance Of August 2022 Forbes Advisor

Best No Exam Life Insurance Of August 2022 Forbes Advisor

Insolvency And Debt Overhang Following The Covid 19 Outbreak Assessment Of Risks And Policy Responses

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)